How to know if you have received a fake IRS collection letter

One day, you receive a letter in the mail appearing to be from the IRS. As you read the letter, you begin to sweat: it’s threatening to seize your property, garnish your wages, levy your bank accounts.

You begin to worry, yet something about this letter just doesn’t seem right – it may seem too extreme, appear to be formatted unprofessionally, or use strange language. Additionally, you may not have heard from the IRS in years, why now?

Your gut tells you the letter may not actually be from the IRS – could it be a fake letter, a scam?

I know, the IRS is scary and confusing enough on its own; it seems cruel to have to consider that there are even scarier entities out there, delivering you with marketing scams, ultimately trying to trick you into giving up your bank information or money.

It seems overwhelming, but it does not have to be. These letters are cleverly disguised tricks from companies attempting to get you to hire them. They are sly, and have obtained your information from public records, most likely if you have had a federal tax lien filed against you.

But like all tricks, they can be easily exposed once you learn how to recognize them.

Let’s take a closer look at some of the tell-tale signs of fake IRS letters. Here are three examples of fake letters, and what a real letter would loook like:

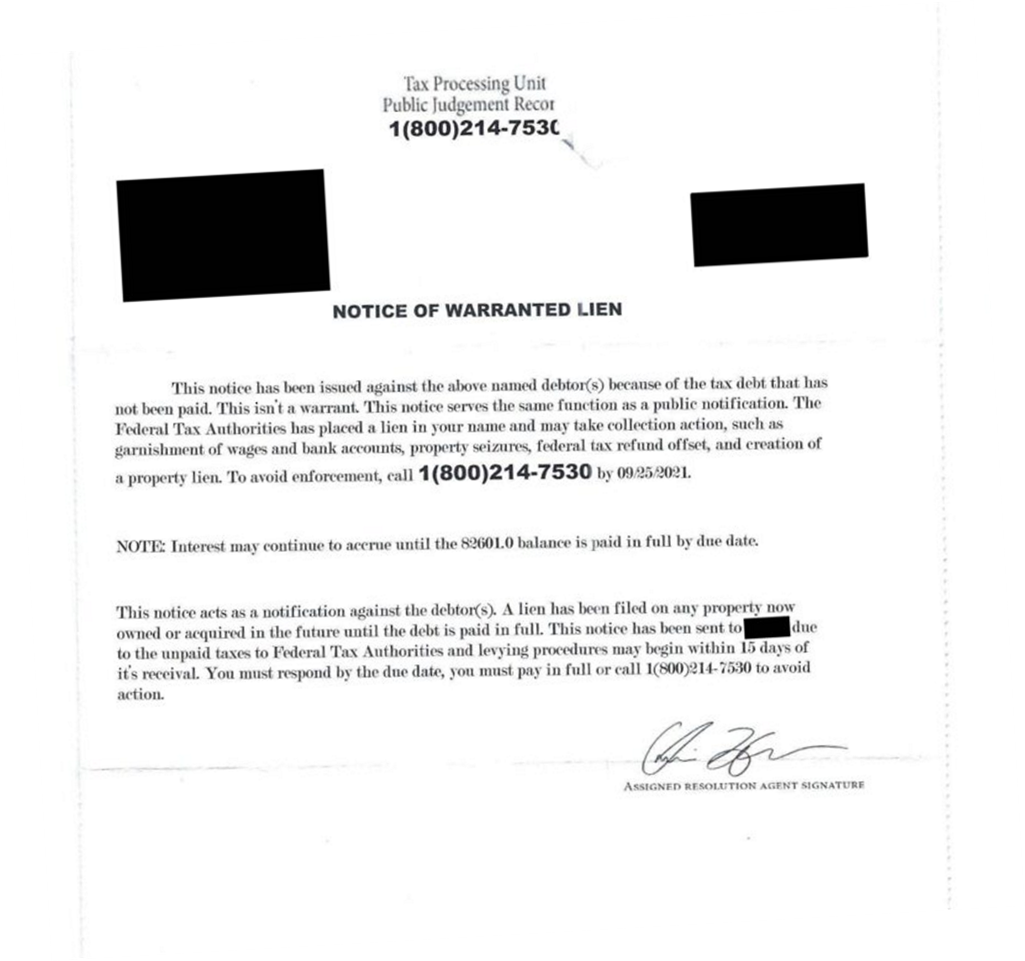

Your letter may have looked something like this:

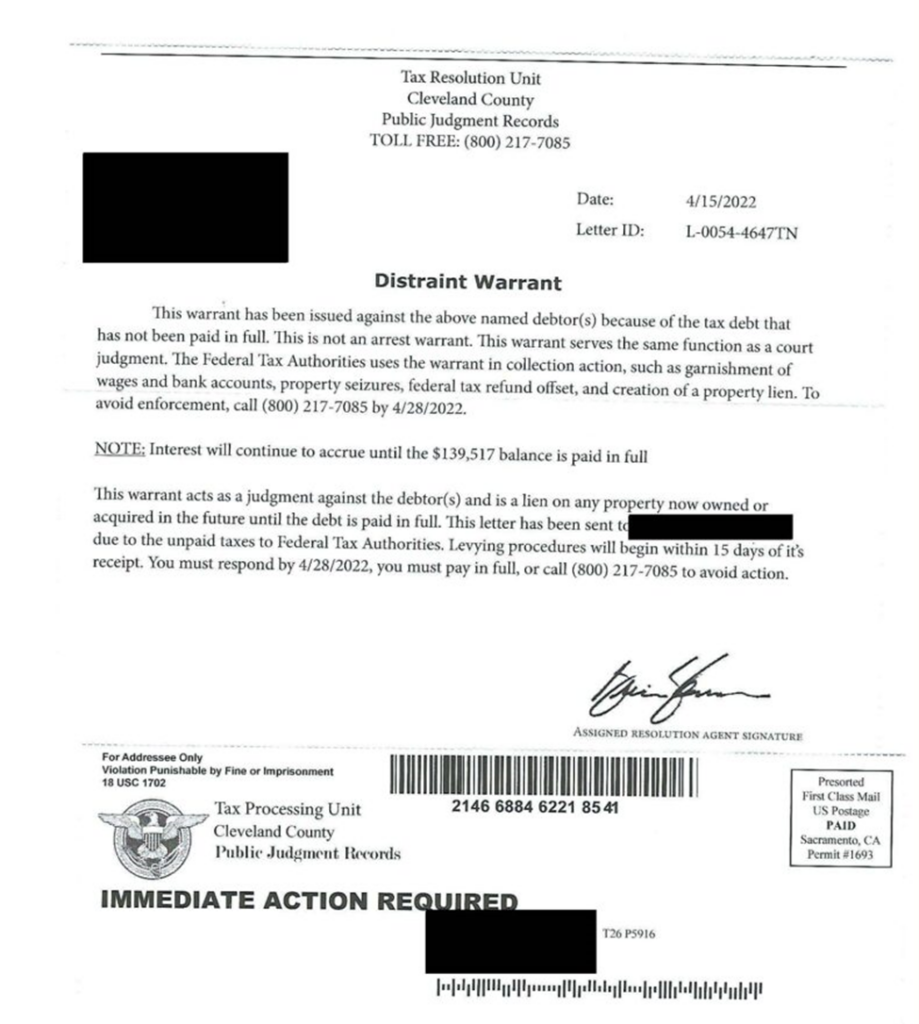

Here is another example of a fake IRS letter:

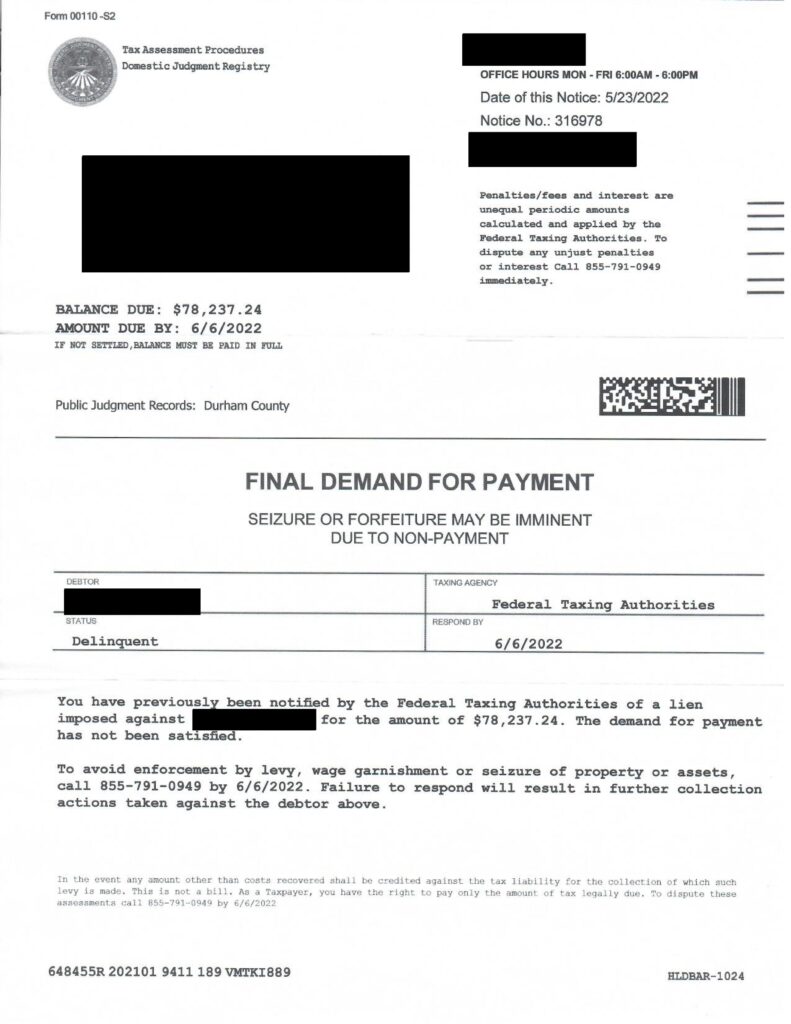

Or your fake letter may have looked like this:

.

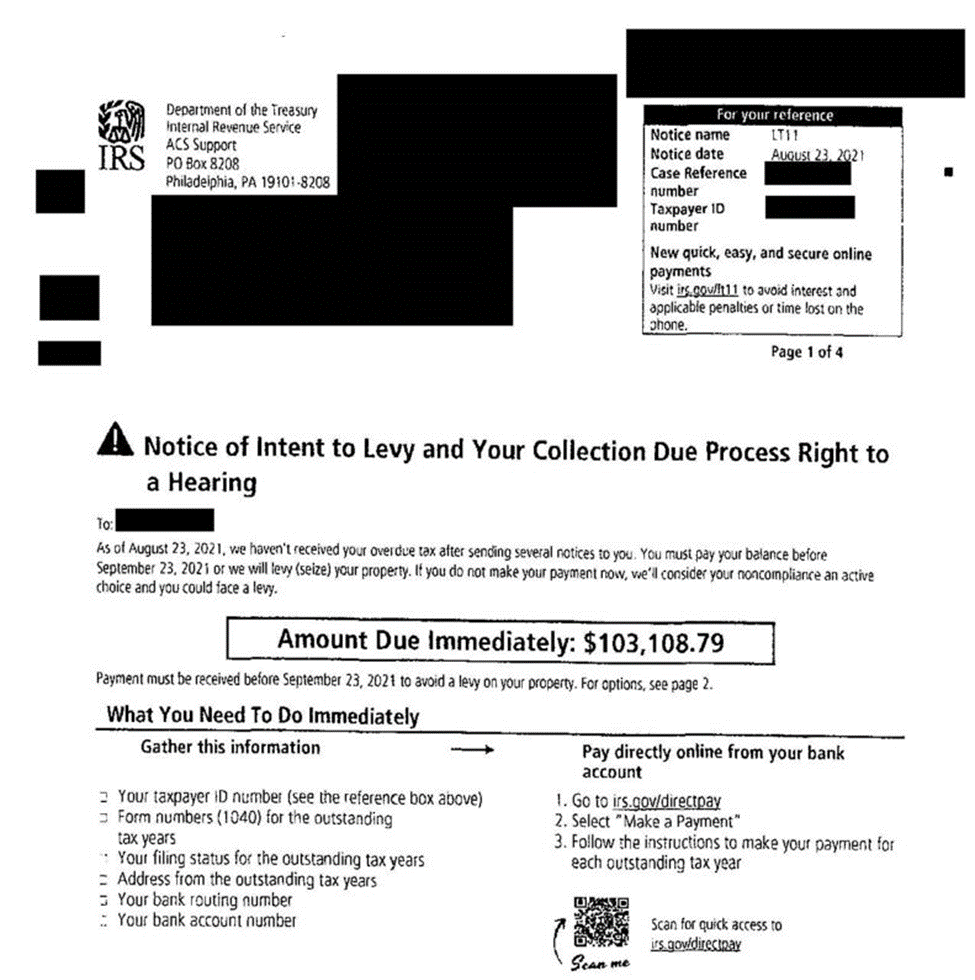

In contrast, a true IRS letter that would allow them to seize your property, garnish your wages, and levy your bank accounts would look like this:

As you can see, the manipulators who send you fake letters are far removed from the reality of our tax laws: they employ language such as “Distraint Warrant,” “Notice of Warranted Lien,” and “Seizure and Forfeiture May Be Imminent due to Nonpayment.” These are phrases the IRS does not use in their collection letters.

The IRS does not send you a letter today and then an agent out tomorrow to take your house. It just doesn’t work that way.

Here’s how it really works:

Before the IRS can take your property, they MUST send you a Final Notice of Intent to Levy With Rights to a Collection Due Process Hearing (shown above). This letter can be readily identified by looking at the upper right hand corner – there you will see the identifiers LT11. This is the code the IRS puts on the final notice of intent to levy – note that the fake letters do not have this identifier.

The most useful tactic to prevent garnishment is to request a Collection Due Process Hearing. Within 30 days of the date of the Final Notice of Intent to Levy (LT11), you have the right to request a Collection Due Process Hearing. At the hearing, you can be granted alternatives to the garnishment of your property, such as an installment agreement, the infamous offer in compromise, currently not collectible status, or even penalty abatement. Once the request for the hearing is filed, the IRS is prevented from garnishing your property, wages, and accounts. By contrast, a fake letter threatens swift action; it’s just not that simple or easy. There is an entire process that must unfold before the IRS can take the steps the fake letters state will happen immediately.

If you are wondering if you have received a Final Notice of Intent to Levy (LT11), we can access your records to determine if and when the notice was sent, and our appeal rights to stop the IRS. Your records are available to us through the IRS Practitioner Priority Line, which is available to attorneys to privately access your records without waking the beast.

We can clearly see how marketing companies try to trick us by using fancy words and symbols to unnecessarily scare you. They also play into our fears of powerlessness against the government – however, we need to remember that you have rights to due process and a hearing, and will not lose your property or wages without proper IRS notice. Now, with an understanding of the actual IRS collection procedures, we can rest easy that these fake letters are nothing to us, and we can safely throw them into our recycling bin.